How your business can prepare for the next climate catastrophe

January 9, 2023

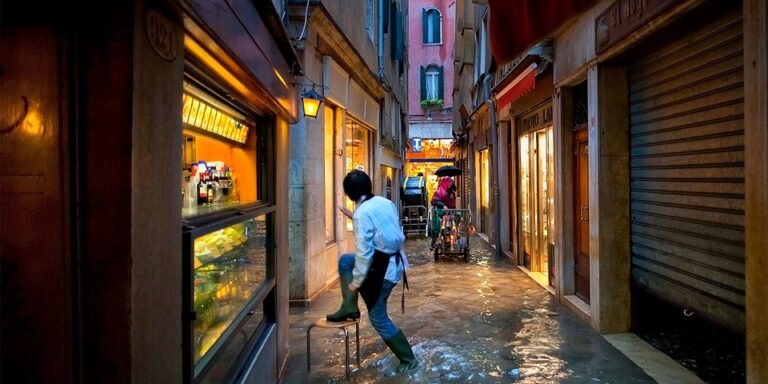

The news of another La Niña has many businesses concerned, especially those in eastern Australia, many of which are still struggling to get up and running following this year’s previous catastrophes.

Disasters such as fires and floods have a horrendous impact on communities: the combined insurance damage from the 2021 and 2022 storms and flooding was $5.92 billion with more than 296,000 claims lodged.

But preparing your business for summer could go a long way towards protecting yourself business from the worst of it.

Take action to protect your business

The most common issue during periods of heavy rainfall is water flooding the building, so it’s crucial that all doors, windows and roof coverings are secured. The Insurance Council of Australia (ICA) has outlined a number of additional steps business owners may be able to take to reduce the potential impact of flooding on property, finances and wellbeing.

ICA’s suggestions include:

- Reviewing all building, contents, and landlord insurance policies and checking cover for flood and storm . Also, check your cover for temporary accommodation for people and pets.

- Reviewing the sum insured for building and contents, checking that the amount matches the current replacement, repair and rebuild costs for your property and contents. You could use a building and contents insurance calculator to check the current value which can help avoid the shock of finding out that you’re underinsured after an event.

- Preparing a room-by-room inventory of the contents of your business. This list can help determine if you have enough insurance and may assist you to save time when making a claim.

- Ensuring you’re covered before the forecast La Niña rain starts to fall, as some insurers may place a temporary embargo on the purchase of new policies if storm and flooding is imminent.

- Taking practical steps such as clearing the gutters and downpipes to help water escape can help to reduce the risk of overflow and damage to walls and ceilings. Ensure your roof, windows and doors can withstand heavy rainfall.

Seek professional advice

It’s also important to get advice from a professional, such as an insurance broker, to better understand how to best manage risks associated with these extreme weather events. This advice could potentially help you avoid financial ruin and can help prevent the loss of your business.

It’s never too late to draw up a plan that can help protect you for these events and if you do have one, now is the time to review it and update it to take into consideration your current needs – especially with the number of extreme weather events that have been occurring.

What government schemes are available?

While insurance for your business is a critical part of any risk-management plan, if you find you are underinsured, you may need extra financial help; there may be grants and programs available to assist you.

One of the worst-hit towns in the recent floods was Lismore, in far northern NSW.

Business owners here and in the surrounding areas, may be able to access the federal and NSW state government co-funded Northern Rivers Commercial Property – Return to Business Support Program, which can provide up to $50,000 to help those impacted by the 2022 floods to help pay the costs associated with re-establishing their businesses.

Small businesses directly affected by a declared natural disaster may also be able to apply for a low interest loan of up to $130,000. These loans are designed to help business return to normal trading and replace and repair damage that is not covered by insurance.

While you’re unable to predict how your business may be affected during climate catastrophes, taking appropriate action to prepare may help you continue to trade or get up and running as soon as possible in the event of a natural disaster.

Important disclaimer – Insurance Brokers Australia Pty Ltd – ABN: 58123301806 – AFS License : 309265, its subsidiaries and its associates. The views expressed are those of the author only and do not necessarily reflect those of Insurance Brokers Australia. This magazine provides information rather than financial product or other advice. The content of this magazine, including any information contained on it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product. Information is current as at the date articles are written as specified within them but is subject to change. Insurance Brokers Australia make no representation as to the accuracy or completeness of the information. Various third parties, including Know Risk, have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Insurance Brokers Australia.