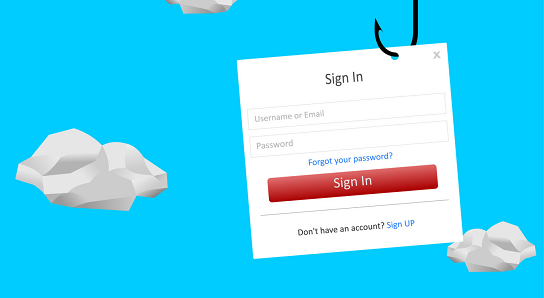

One click is all it takes…

September 11, 2020

There’s a common misconception that cyber attacks target big business and ‘small fry’ are not under threat. Unfortunately SMEs are more threatened because they often don’t have the superior security systems that larger organisations can afford and, if they are attacked, the ramifications are higher because they have to spend so much time, effort and resources to counter the attack that they risk the business going under.

From 1 July 2019 to September 2019 the ACSC’s cyber crime reporting tool, ReportCyber, received almost 14,000 reports. That’s an average of around 148 reports a day, or one cybercrime report every ten minutes. Over this time, individuals and small to medium businesses self-reported financial losses to ReportCyber of more than $890,000 each day, representing an estimated annual loss of approximately $328 million. While malicious or criminal attacks were the main data breach sources in the scheme’s first year, many of those incidents exploited human vulnerabilities, such as clicking on attachments to fake emails or inadvertently disclosing passwords.

Most big businesses have dedicated IT teams and broad cyber protection software; SMEs that don’t have a dedicated cyber security team within arm’s reach have more to lose when a cyber attack occurs. When a smaller company gets attacked, what do they do? Who do they talk to? What if you pay the ransomware and they attack you again? What do they tell their customers that now don’t trust emails from them? A cyber attack might cripple a company, but the customers that then leave because of the reputational risk will close the company down.

Now take into account the COVID-19 pandemic, we have people working from home, we’re recieving emails from companies whose staff are working from home and if our home computer gets infected, this could now affect your partner and your kids. What happens if you inadvertantly allowed a hacker into your family home and they exploite your children. Insurance Brokers Australia is now offering Australia’s first stand-alone personal cyber policy to combat the impact of cyber and identity fraud for Australian families and individuals. For a small cost you have a safety net of IT Professionals working to get your family back on their feet.

Cyberbullying is increasingly commonplace, especially among young people who may not have enough awareness about the harm their actions cause when they bully and harass their peers online. Cyberbullying involves the misuse of power with technology. Examples include threatening to publish explicit photos online without your authorisation, encouraging others to bully or ignoring, vilifying and spreading rumours on social media. A personal cyber cover could assist your family with a cyber coach to provide guidance, access to counsellors and legal specialists if required.

Cyber cover for your business and family is just as important as insuring your home. The difference is a criminal will leave, a cyber criminal won’t until they’re certain they can’t get anything more out of you or your family.

Important disclaimer – Insurance Brokers Australia Pty Ltd – ABN: 58123301806 – AFS License : 309265, its subsidiaries and its associates. The views expressed are those of the author only and do not necessarily reflect those of Insurance Brokers Australia. This magazine provides information rather than financial product or other advice. The content of this magazine, including any information contained on it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product. Information is current as at the date articles are written as specified within them but is subject to change. Insurance Brokers Australia make no representation as to the accuracy or completeness of the information. Various third parties, including Know Risk, have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Insurance Brokers Australia.